B40 M40 and T20 Malaysia refer to the household income classification in Malaysia. On the First 2500.

How To Calculate Foreigner S Income Tax In China China Admissions

If husband and wife are separately assessed and each chargeable income does not exceed RM35000.

. Represents 40 of Malaysians. The following rates are applicable to. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

B40 represents the Bottom 40 M40 represents the middle 40 whereas T20 represents the top 20 of Malaysian household income. On the First 2500. Total tax amount RM150.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021. In 2019 the average monthly income in Malaysia is RM7901.

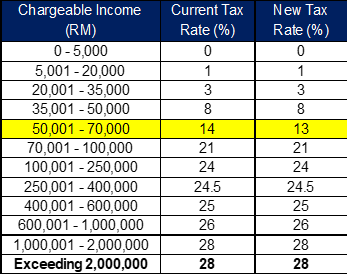

Taxable income band MYR. Information on Malaysian Income Tax Rates. Thats a difference of RM1055 in taxes.

Sales tax fully waived for new passenger vehicles. Chargeable income RM20000. Overall income that is earned by household members whether in cash or kind and can be referred to as gross income.

Individuals chargeable income does not exceed RM35000. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. Up to RM3000 for kindergarten and daycare fees.

It should be noted that this takes into account all your income and not only your salary from work. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. 13 rows Personal income tax rates.

Taxable income band MYR. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Income Tax Rates and Thresholds Annual.

More than RM10970 and above. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. No other taxes are imposed on income from petroleum operations.

Is the middle income number within. 100 exemption on import and excise duties sales tax and road tax for electric vehicles. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

RM9000 for individuals. On the First 5000 Next 15000. Taxable income band MYR.

While you must file your taxes you may not necessarily have to. Household Income and Basic Survey Amenities Report 2019 DOSM. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Malaysia Residents Income Tax Tables in 2022. Year Of Assessment 2001 - 2008 RM Year Of Assessment 2009 Onwards RM a. Represents the top 20 of Malaysians.

On the First 50000 Next 20000. Taxable income band MYR. In 2016 and 2019 average income recipients in Malaysia was 18 persons.

Malaysias Individual Income Tax Rate is 15. 20212022 Malaysian Tax Booklet. Income Tax Rebates For Resident Individual With Chargeable Income Less Than RM35000.

Rebate for Zakat Fitrah or other Islamic religious dues paid. On the First 35000 Next 15000. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN.

There are no other local state or provincial government. Taxable income band MYR. Tax rates on chargeable income of resident individual taxpayers are calculated on a graduated scale with the lowest rate being 0 percent on the first RM5000 of chargeable income and the highest rate reaching 30 percent on chargeable income surpassing RM2000000 taking effect from the year 2020.

Income Tax Rates and Thresholds Annual. 400 each If husband and wife are jointly assessed and the joint chargeable income does not exceed RM35000. Personal Tax 2021 Calculation.

Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment. Here are the progressive income tax rates for Year of Assessment 2021. Chargeable Income Calculations RM Rate TaxRM 0 - 5000.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Annual income RM36000.

Malaysia Residents Income Tax Tables in 2020. Chargeable Income Calculations RM Rate TaxRM 0 2500. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

Taxable income band MYR. Kindly take note that theres no update yet for the B40 income range for the year 2021. Total tax reliefs RM16000.

Ali work under real estate company with RM3000 monthly salary. On the First 20000 Next 15000.

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Budget Highlight 2021 Taxletter 26 Anc Group

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

7 Tips To File Malaysian Income Tax For Beginners

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

Tax Guide For Expats In Malaysia Expatgo

Individual Income Tax In Malaysia For Expatriates

Malaysian Tax Issues For Expats Activpayroll

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysia Budget 2021 Personal Income Tax Goodies

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysian Bonus Tax Calculations Mypf My